Sydney, 8th December 2025

Amid the many challenges facing the diamond market in China, jewelry retail appears to have stabilized.

Chow Tai Fook’s revenue slipped just 1% in the fiscal half year ending September 30, with same-store sales rising in both Mainland China and Hong Kong-Macau. Luk Fook Holdings, another leading regional jeweler, reported a 26% jump in revenue and a 44% surge in profit during the same period.

Still, most of that growth came from the fixed-price gold jewelry segment. Luk Fook’s diamond sales, by contrast, continued to fall in the low double digits.

Consumer caution remains tied to China’s sluggish economic climate, which has lingered since the 2020 pandemic. Households have focused more on saving than spending after the Covid-19 lockdown experience. Younger consumers are shifting their priorities away from traditional luxury purchases, marriage rates have dropped, and geopolitical tensions—both with the US and across the Asia-Pacific region—are compounding the slowdown.

Meanwhile, jewelers such as Chow Tai Fook and Luk Fook have benefited from a surge in gold demand. Chinese consumers maintain deep cultural and financial connections to gold, viewing it as a dependable store of value in uncertain times.

As a result, retailers have leaned more heavily into gold, dialing back their focus on diamonds. Gem-set jewelry, which includes diamonds, made up just 26% of Chow Tai Fook’s fixed-price jewelry sales in the fiscal half year, down from 33% a year earlier.

That shift is not limited to the big players. Over the past two years, retail jewelers across Greater China have been offloading diamond inventory — often at sharp discounts — adding to the lingering surplus of polished goods in the midstream.

Wholesale demand remains subdued across most size categories, including the 0.30- to 1-carat range that is considered the sweet spot of Chinese demand. Retailers are sitting on enough stock to meet near-term needs and have little incentive to buy for inventory. The major chains, meanwhile, are less active in the polished trading market, relying instead on their own manufacturing units to supply in-house requirements.

All of this has fueled a gradual transformation in China’s diamond market, a shift that began even before Covid-19.

While the major jewelry chains are squeezing out growth on the back of strong gold demand, the diamond segment remains under strain. Some expect a degree of stabilization in 2026, but activity is still far below the heights of the 2010s, when China was the driving force behind global diamond growth. More recently, the slowdown that began in 2019 has weighed heavily on the global diamond market. At this point, stability in China’s diamond market, even at lower levels, would be a welcome outcome.

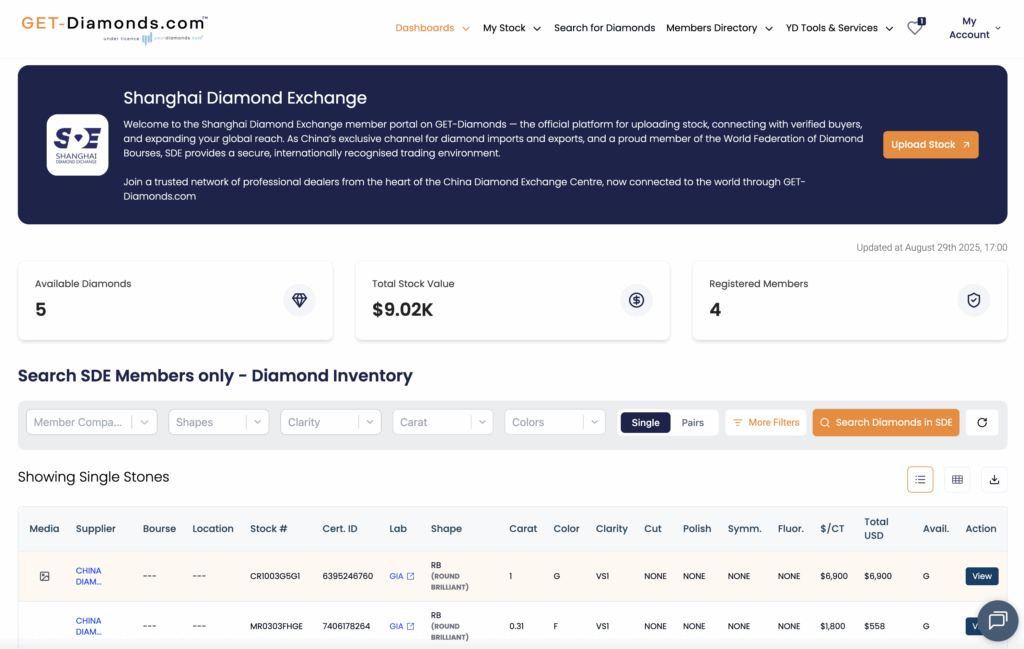

The SDE × GET Hub: Launched at CIIE

The Shanghai Diamond Exchange has responded decisively to the changing market by launching its new digital trading hub on GET-Diamonds.com, unveiled at the 8th China International Import Expo (CIIE) in November this year. Chinese retailers can source smarter. Global suppliers can join the SDE and reach serious Chinese buyers.

Explore the new SDE Hub → Now live on GET-Diamonds.com